What is a stock breakout and how to trade it ?

"Unlocking Stock Breakouts: A Comprehensive Guide to Trading Strategies"

A stock breakout is a technical analysis term used to describe a situation where a stock's price moves above or below a significant level of support or resistance. This movement is often accompanied by increased trading volume and can signal a potential change in the stock's trend. Breakouts can be powerful trading opportunities if identified and executed correctly.

Types of Stock Breakouts

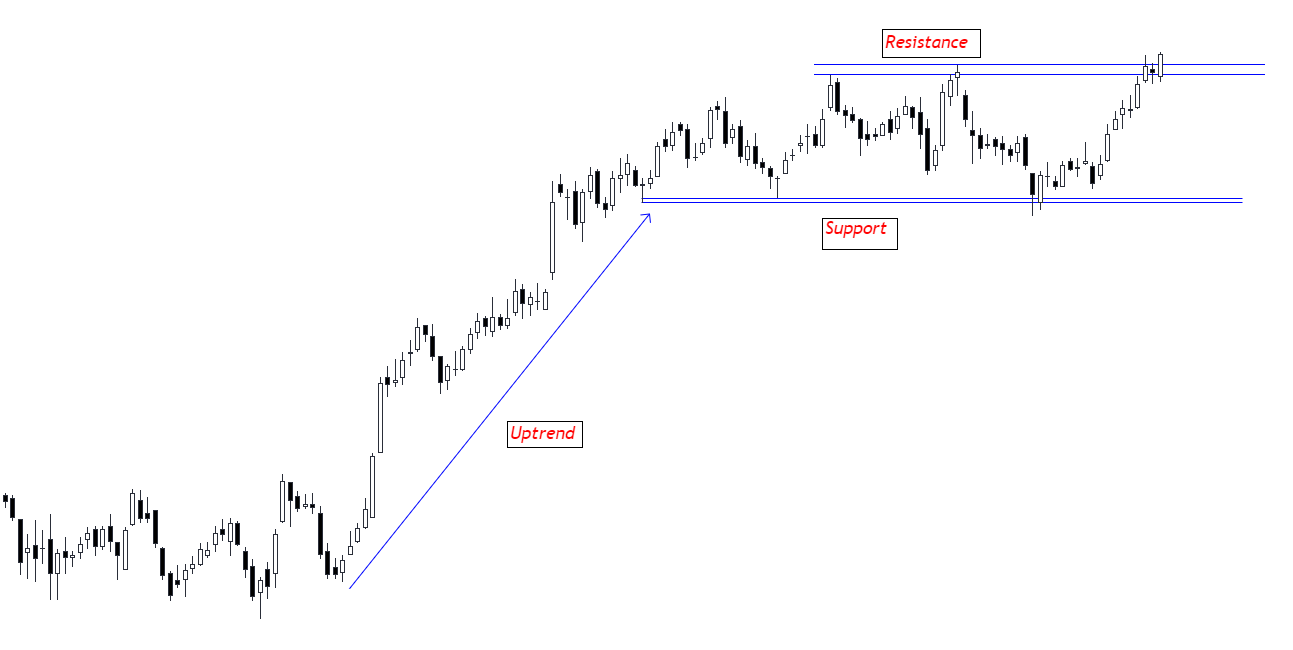

Resistance Breakout: When a stock's price surpasses a key resistance level, it signifies that bullish momentum has taken over, and the stock is likely to continue rising.

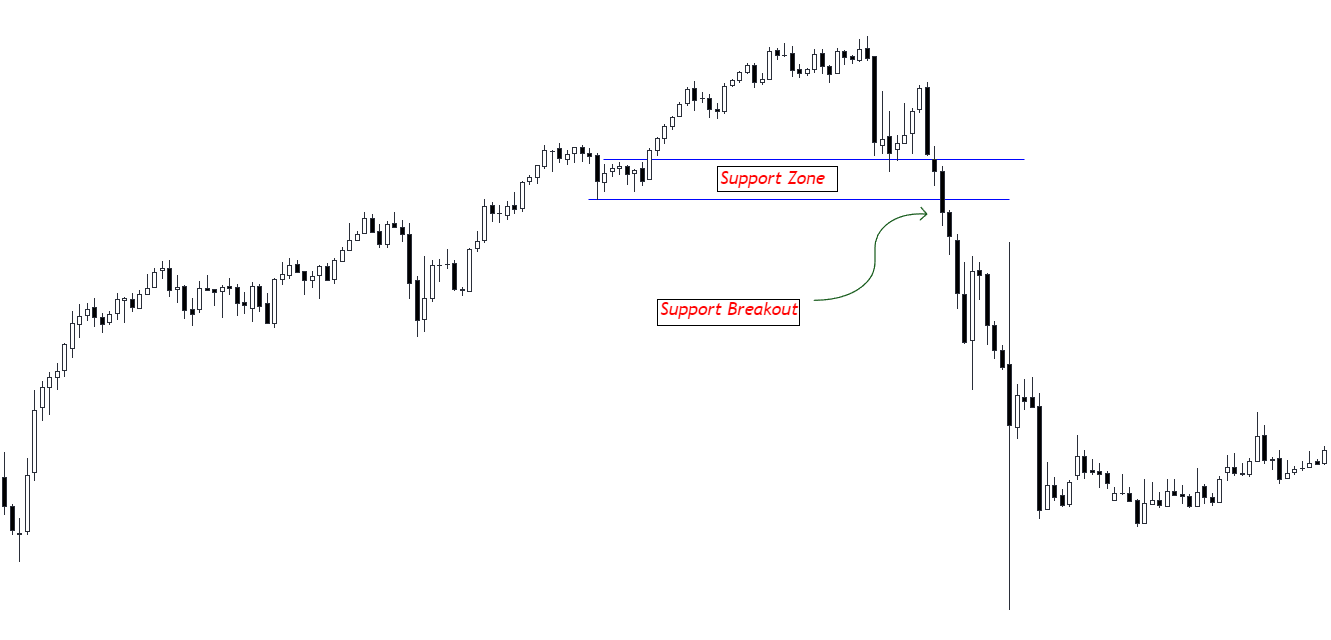

Support Breakout: Conversely, a support breakout occurs when a stock's price falls below a crucial support level, indicating bearish sentiment and the potential for further declines.

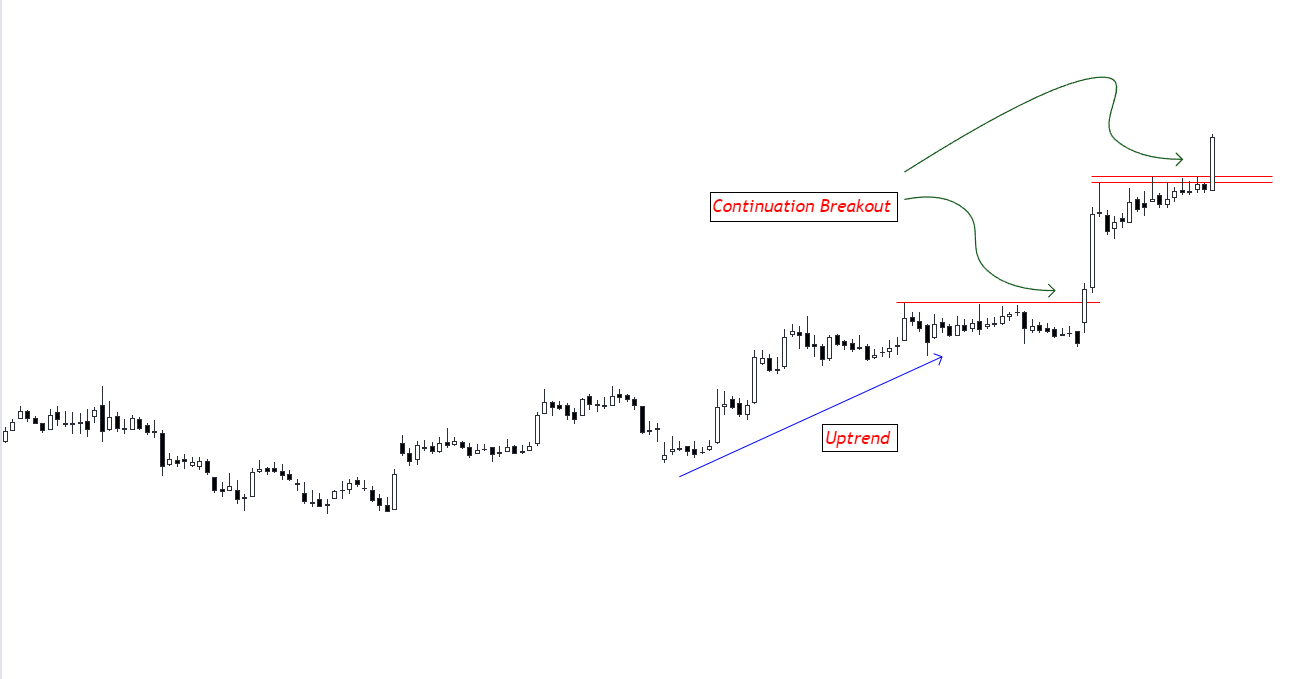

Continuation Breakout: These occur within an existing trend when the stock's price consolidates temporarily before resuming its primary direction. Traders look for continuation breakouts to ride the trend.

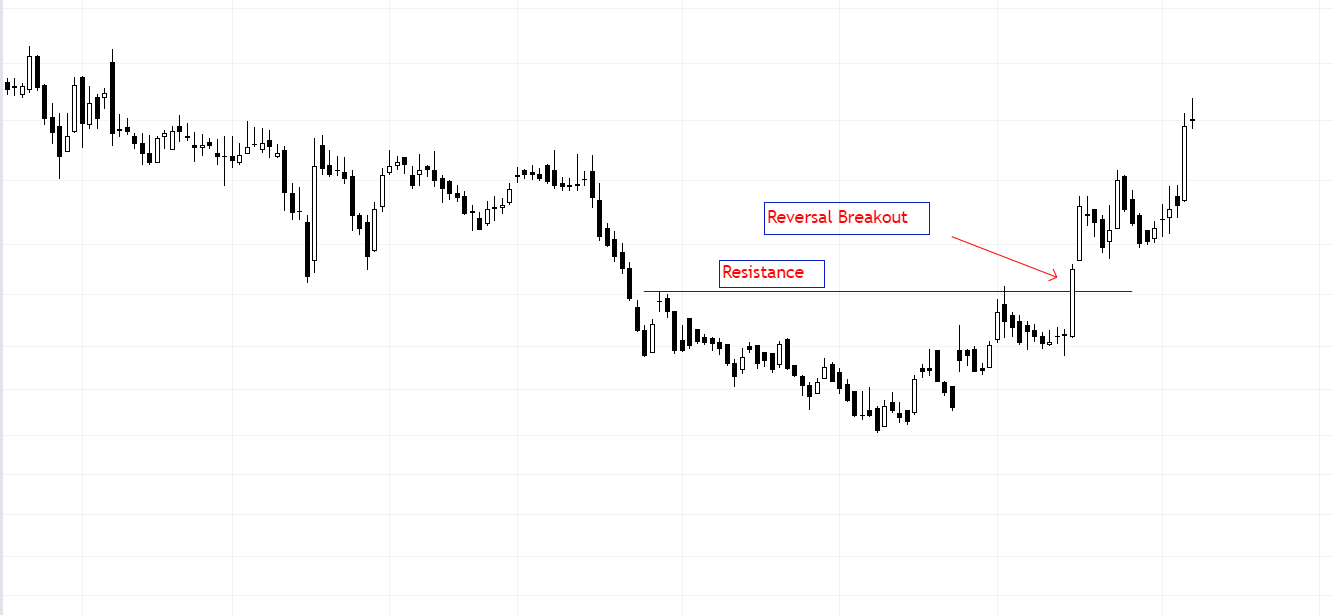

Reversal Breakout: In contrast, a reversal breakout signals a change in trend direction. Traders watch for these breakouts to catch a trend reversal early.

How to Trade Stock Breakouts

Now that we've defined stock breakouts, let's explore how to trade them effectively:

Identify Breakout Candidates: Use technical analysis tools like trendlines, support, and resistance levels, and moving averages to identify potential breakout candidates. Look for stocks with a history of strong price movements and high trading volumes.

Confirm with Volume: Volume is a critical indicator when trading breakouts. A surge in trading volume during a breakout confirms the strength of the move. Higher volume indicates greater conviction among market participants.

Set Entry and Exit Points: Determine your entry point just above the breakout level for long trades and just below for short trades. Set stop-loss orders to limit potential losses and take-profit targets to secure profits.

Use Risk Management: Always manage your risk by sizing your positions appropriately. Never risk more than you can afford to lose in a single trade. Consider using trailing stops to protect profits as the stock's price continues to move in your favor.

Stay Informed: Keep an eye on news and events that may impact the stock you're trading. Unexpected developments can reverse a breakout quickly, so stay informed and be prepared to adjust your strategy.

Practice Patience and Discipline: Patience is crucial when trading breakouts. Not every breakout will be successful, so be prepared for losses. Stick to your trading plan and avoid emotional reactions to market fluctuations.

Backtest and Learn: Continuously analyze your trading results and refine your strategy. Backtesting historical data can help you understand the effectiveness of your approach and make necessary adjustments.

Conclusion

Stock breakouts offer exciting opportunities for traders to profit from price movements and changes in market sentiment. By understanding what stock breakouts are and employing a disciplined trading strategy, you can enhance your chances of success in the stock market. Remember that trading carries risks, and it's essential to be well-prepared and informed before executing any trades. With practice and experience, you can become a skilled breakout trader and potentially unlock significant profits in your trading journey.

Follow Us on Twitter - Trading Hustler

If you are interested to learn Trading and Investing through book, we have some book recommendation. Go and read them from here